The guide to resume tailoring. Pleasanton ca managed all aspects of us.

How To Become A Tax Manager Jobhero

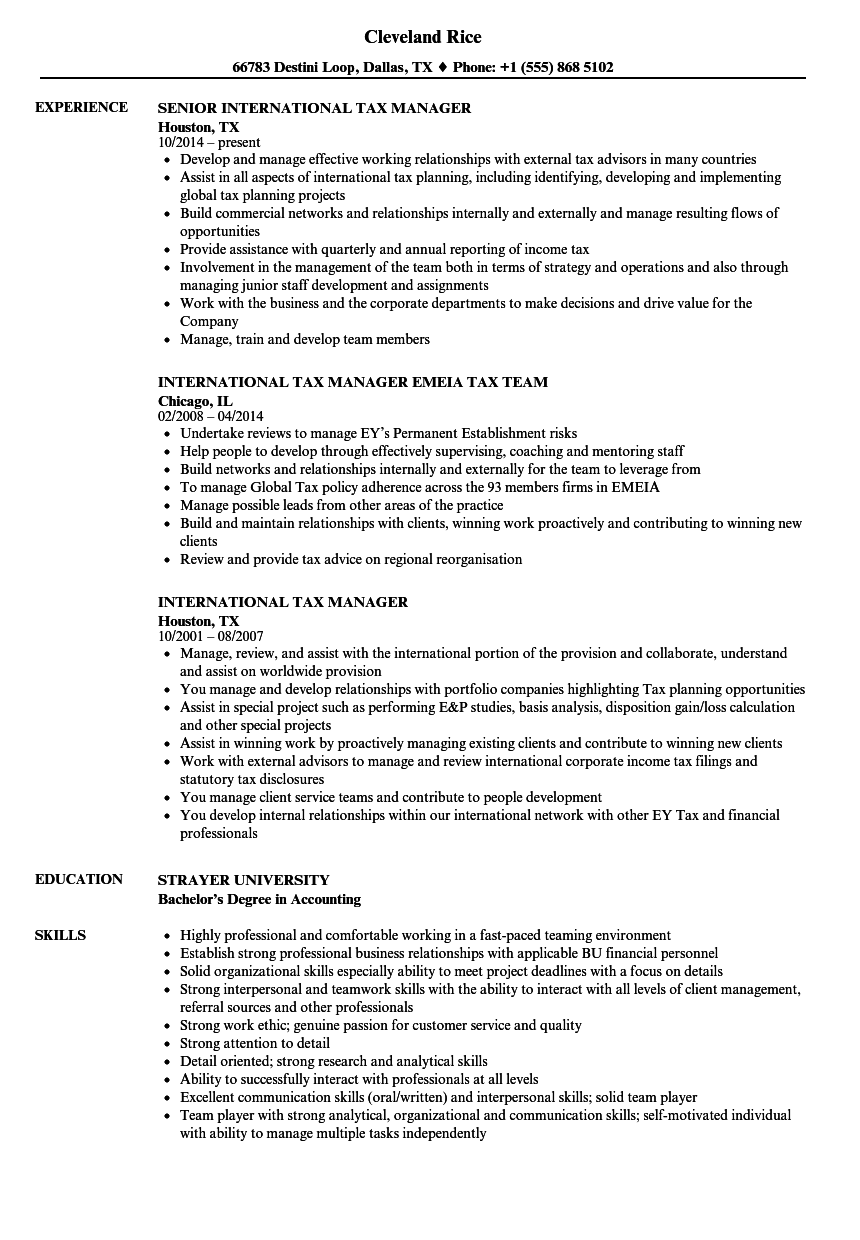

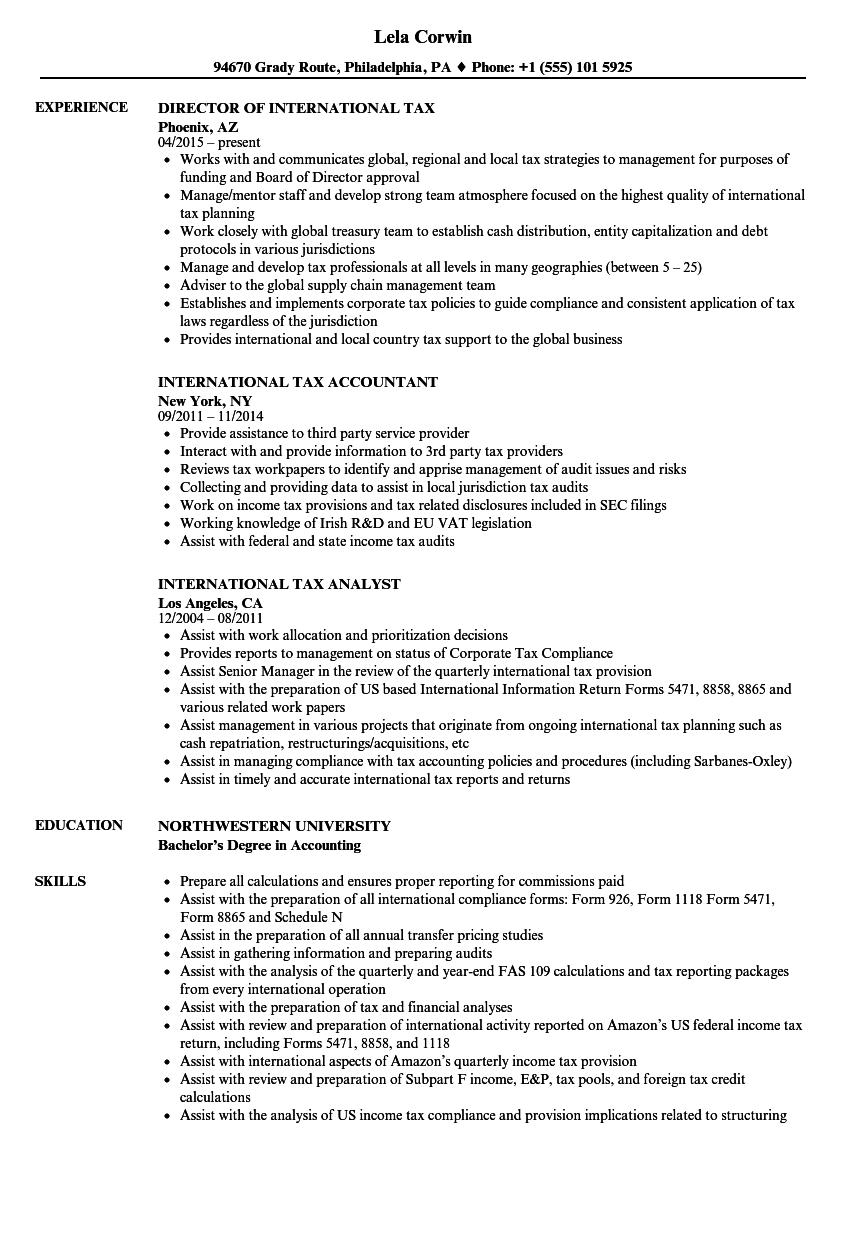

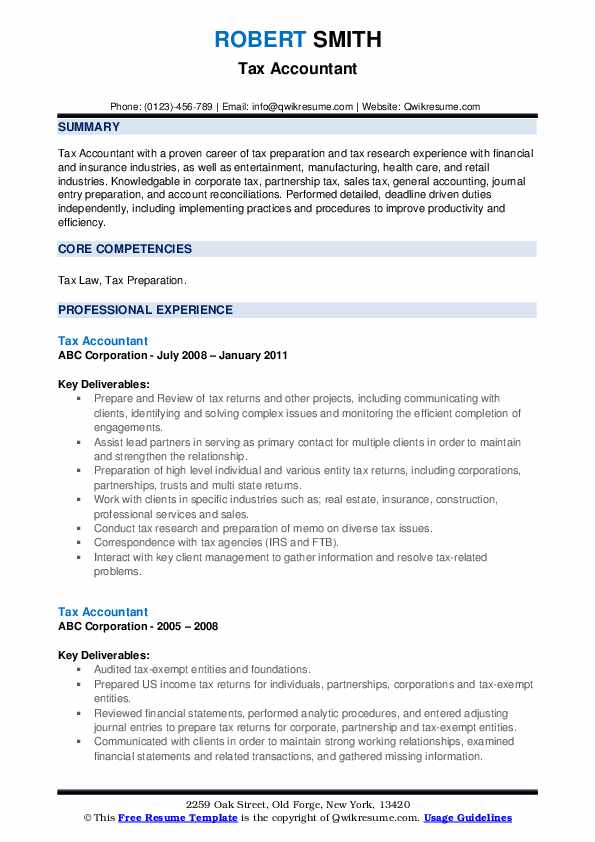

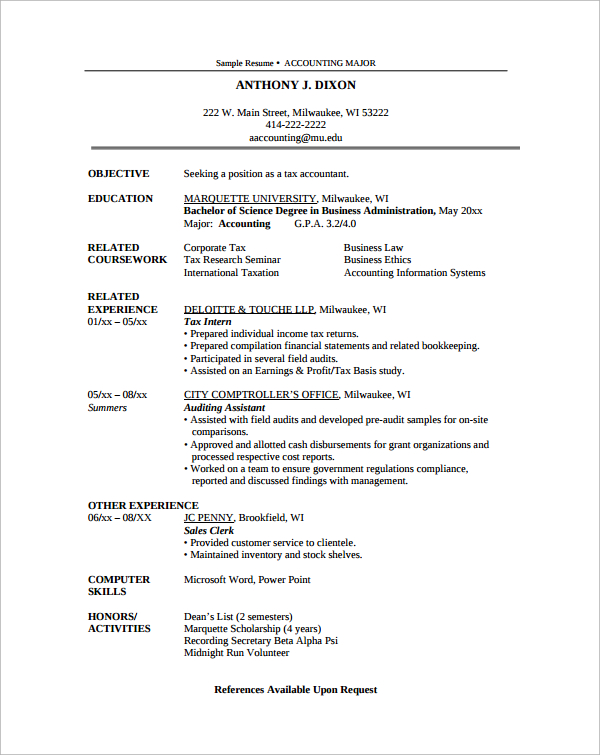

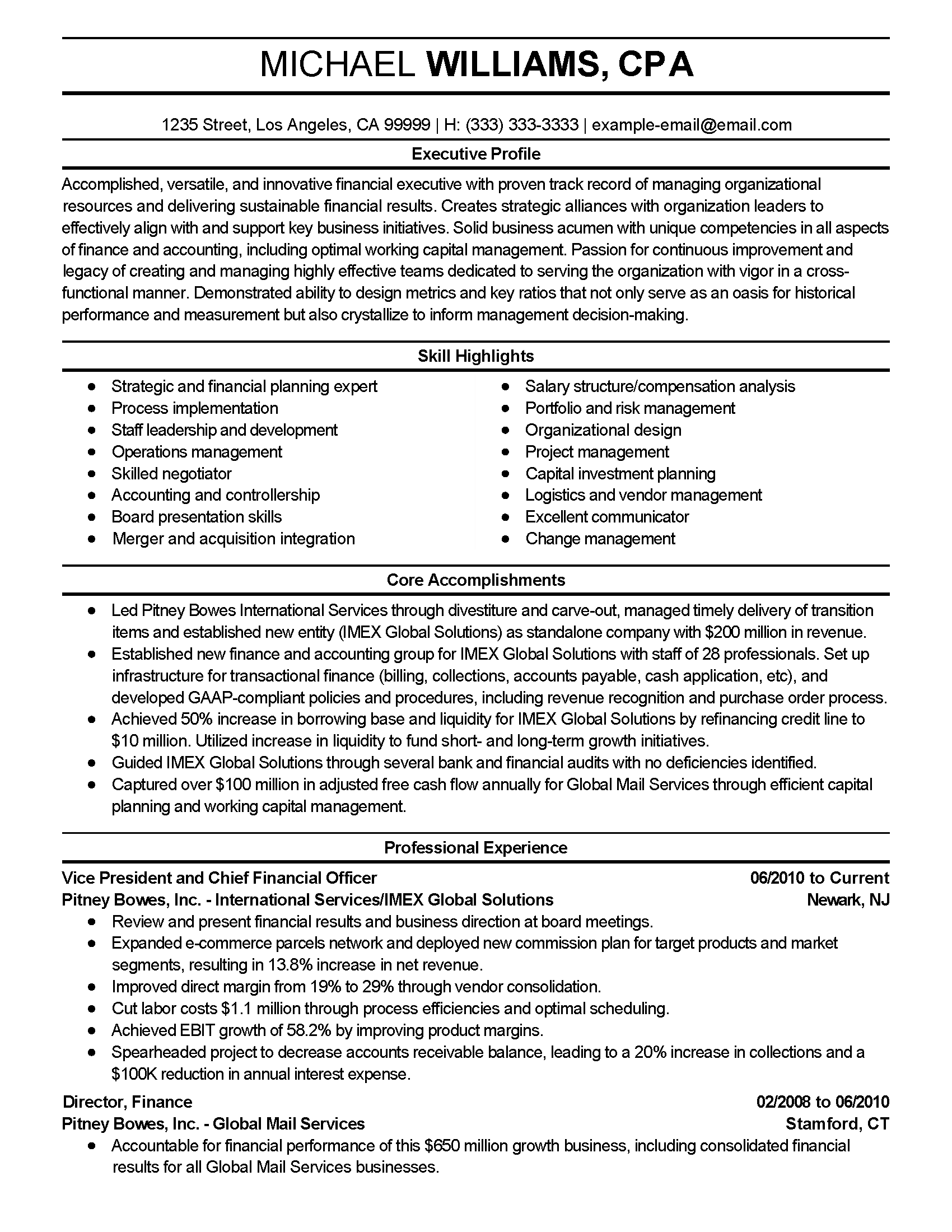

International tax manager resume. Heshe also plays the roles and duties of an international tax director. Tax manager 012008 to 062015 the cooper companies inc. Hisher functions vary from one nation to another. Income tax provision in accordance with asc 740 including m 1 adjustments. Its actually very simple. Our certified professional resume writers can assist you in creating a professional document for the job or industry of your choice.

Participating in developing testing and enhancing new tax provision applications. International tax manager resume samples 47 44 votes for international tax manager resume samples. The international tax manager responsibilities and tasks include working as a global tax administrator in the establishment. A tax director or tax manager is responsible for creating enforcing and overseeing a tax plan for a business or on behalf of an individual client. This resume was written by a resumemycareer professional resume writer and demonstrates how a resume for a international tax manager resume sample should properly be created. And preparing financial projections forecasts.

Prepared and reviewed quarterly and annual us. The average sample resume for tax manager lists duties such as filling tax returns nurturing client relationships preparing various documents that will be submitted to tax authorities supervising taxation departments staff and helping with the completion. Dynamic and highly qualified international tax manager with extensive experience in the interpretation and application of asc 740 and consulting and tax planning related to structuring and financing international operations offshore deferral repatriation and utilization of foreign tax credits. Tax managers handle a companys taxation issues and make sure the lowest possible amount of taxes is paid without breaking fiscal laws. Typical responsibilities of an international tax manager include. Guide the recruiter to the conclusion that you are the best candidate for the international tax manager job.

Minimum of 5 years of tax experience gained within a public accounting law firm or equivalent experience minimum of 3 years of specialized international tax consulting experience required including proficiency in both inbound and outbound topics. International tax consulting manager resume examples samples. Skills listed on a sample tax directors resume include analyzing brokerage statements for high net worth clients. Domestic and international tax and reporting compliance including federal consolidated multi state incomefranchise and international informational tax returns. Overseeing compliance with tax regulation as it relates to specific business lines products or another concern of the organization delivering value in terms of calculating accurate projections of tax liabilities filing reports on time and within the requirements of the law and other things that advance the firms interests.