Established in 1981 cvc is a world leader in private equity and credit. Eqs private equity team is very experienced and widely known both in the international and domestic private equity markets.

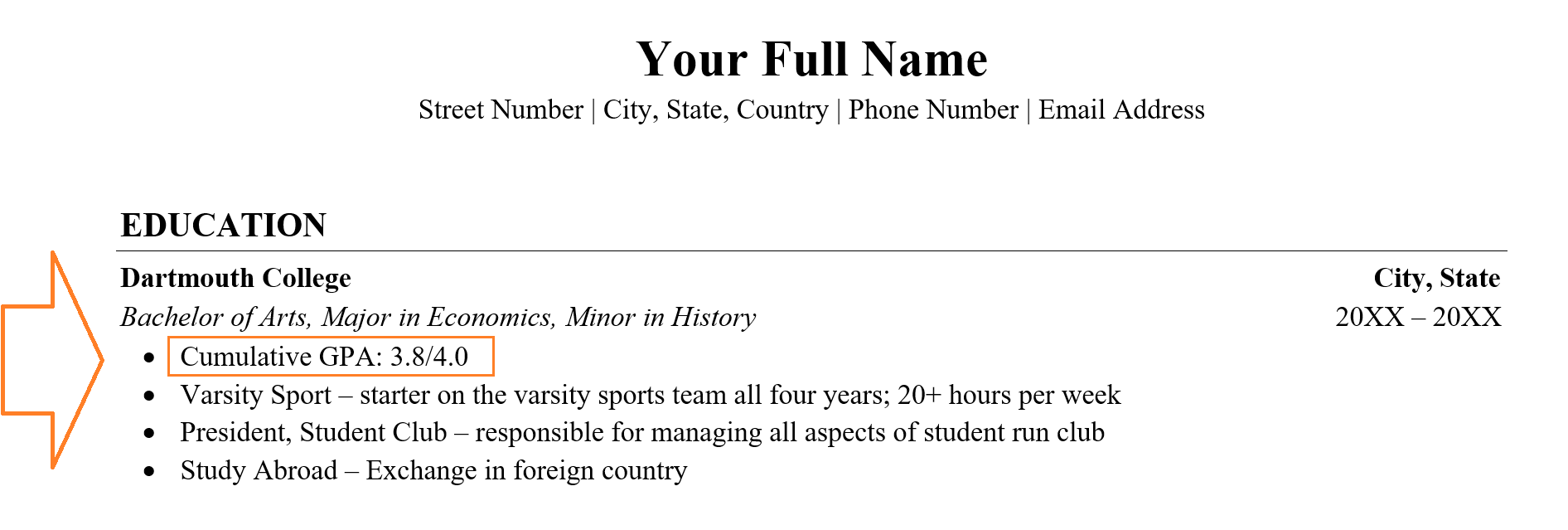

Gpa On Resume Guide Example When To Round Up Gpa

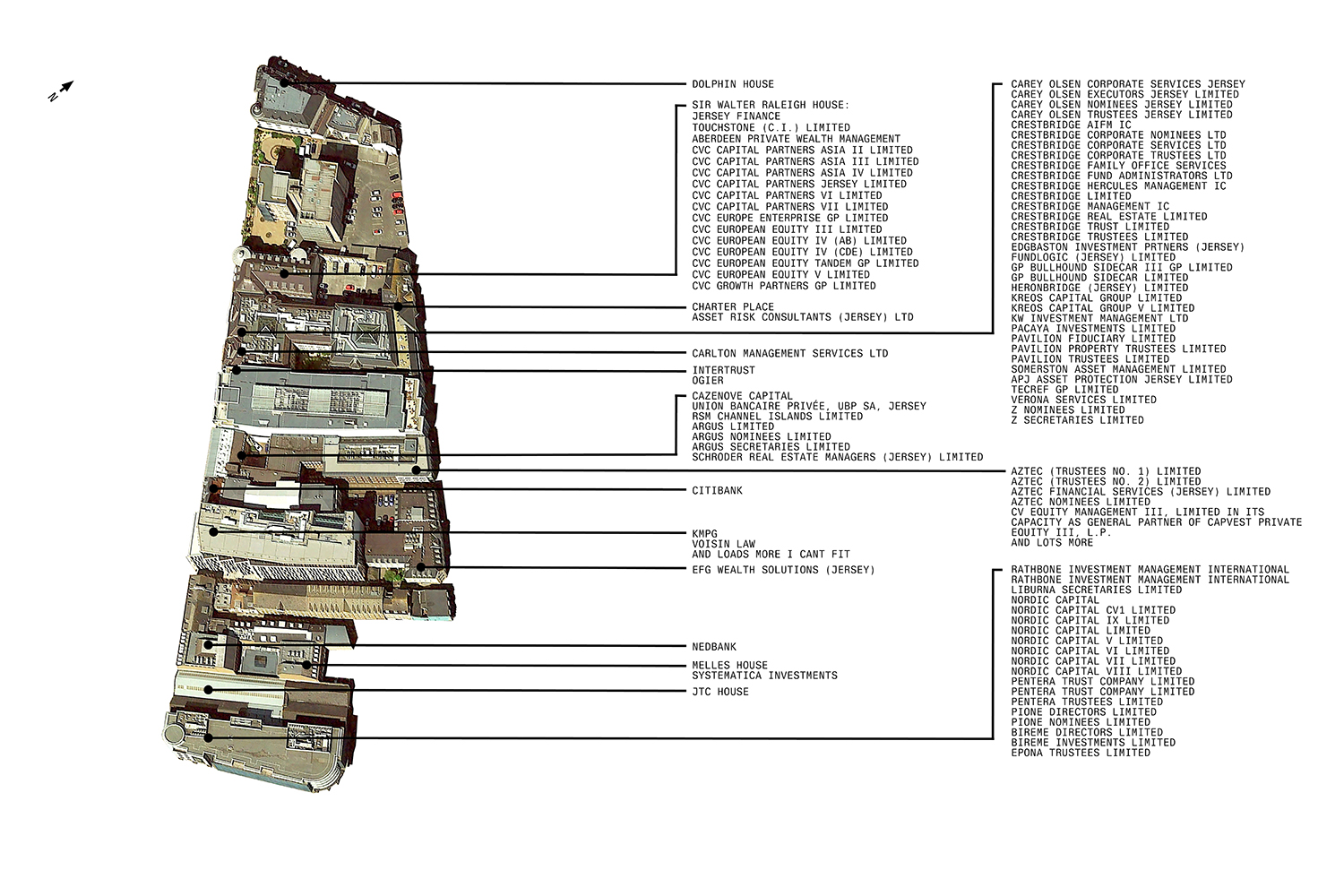

Cv equity management iii limited. Gorman mayo clinic we admire zhi and bvcfs vision they have taken the initiative to invest in a dynamic and important field and done so with rare ability. Cv equity management iii limited. But all private investments are not created equally. Co ogier fund admin. Street address 1 street address 2. The incremental capital along with the uninvested pool in the fourth fund will be invested in consumption driven companies in india a senior company.

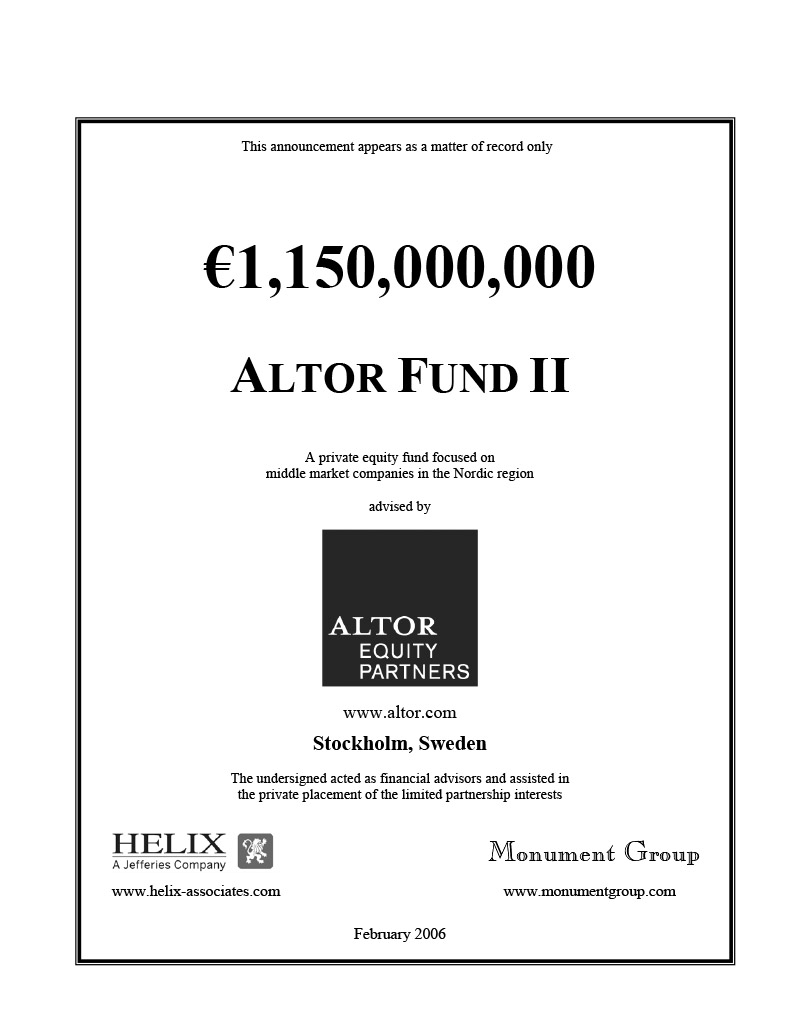

Bvcf delivers outsize venture like returns by taking limited growth equity risk in the unique industry of healthcare in china. The combined private equity investment experience of the team exceeds 70 years. The team also provides strategic and operational advice to management teams on a variety of improvement measures. It represents a significant milestone in azaleas vision of broadening the co investor base for investment products or platforms based on diversified portfolios of pe funds. Et al case number 317 cv 02177 from california northern court. The cvc capital markets team established in 1999 is widely recognised as a pioneer and leader in private equity financing as well as having significant equity capital markets expertise.

The us based alternative investment manager investcorp has acquired idfc groups private equity and real estate investment management business and plans to incrementally raise 50 million towards idfcs existing fourth fund. Parties docket activity and news coverage of federal case global equity management sa pty. Private equity and debt investments have become increasingly important portfolio allocations as investors seek new sources of alpha and yield. Astrea iii is the first listed pe bond in singapore backed by cash flows from private equity pe funds. Ogier house the esplanade. It has a global network of 24 offices 15 across europe and the americas and nine in the asia pacific region and is majority owned by its employees and led by its managing partners.

For nearly two decades pinebridge has focused on offering our clients access to market areas where we believe unrecognized growth potential exists. All investment directors in the team are members of numerous investment committees of both foreign and domestic funds.