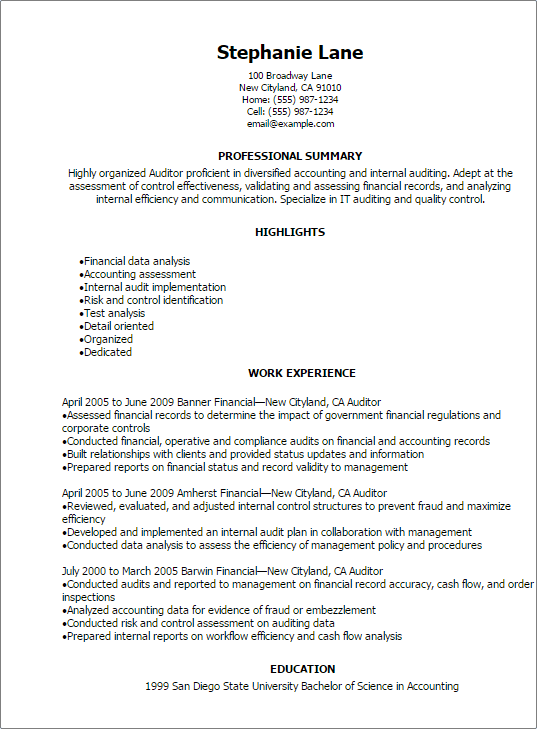

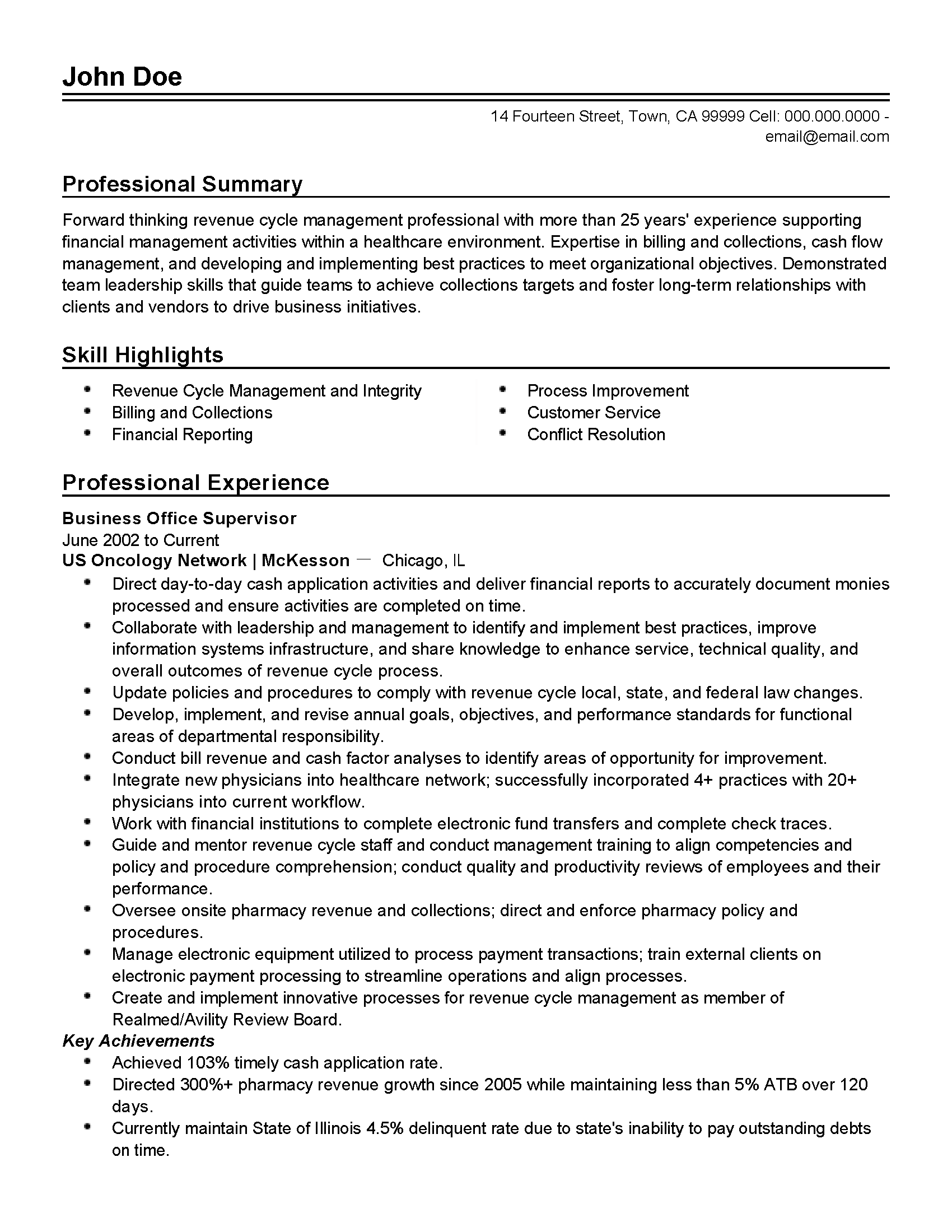

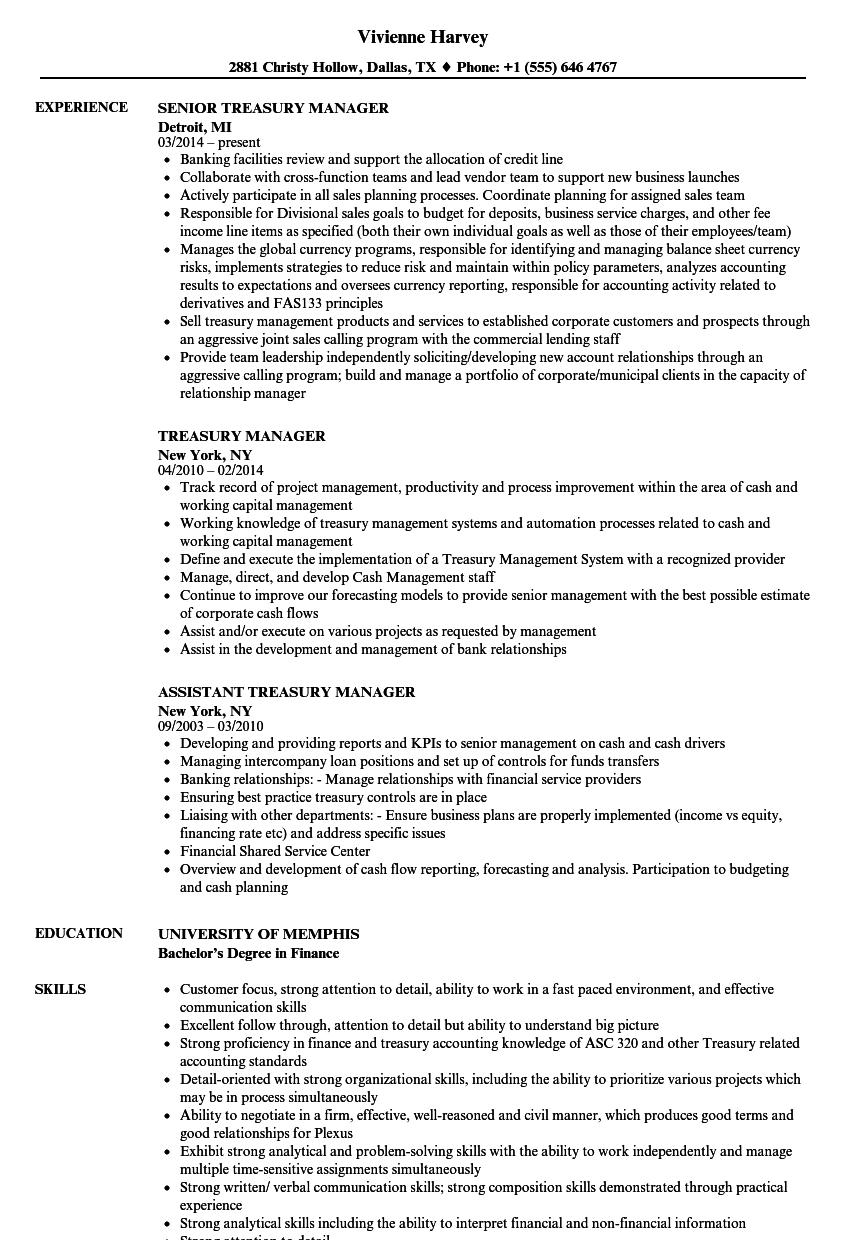

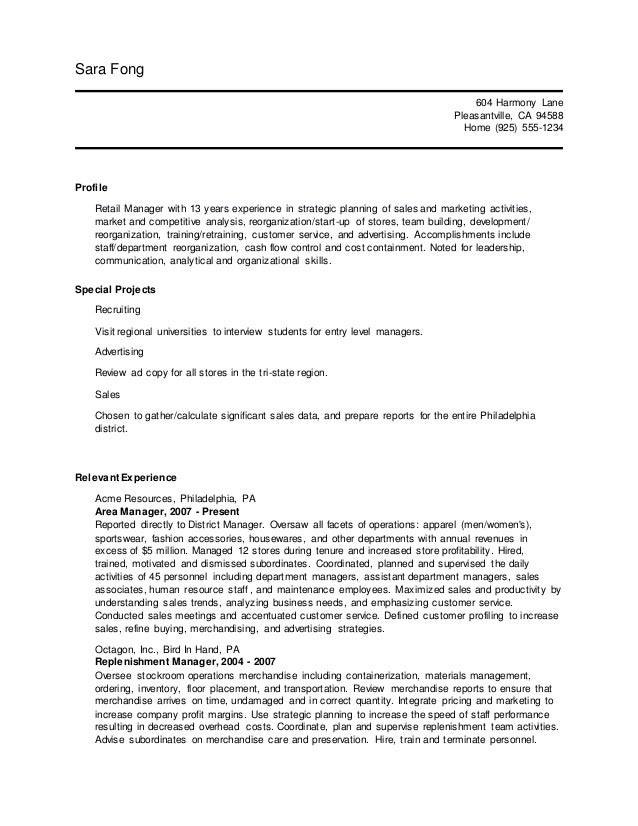

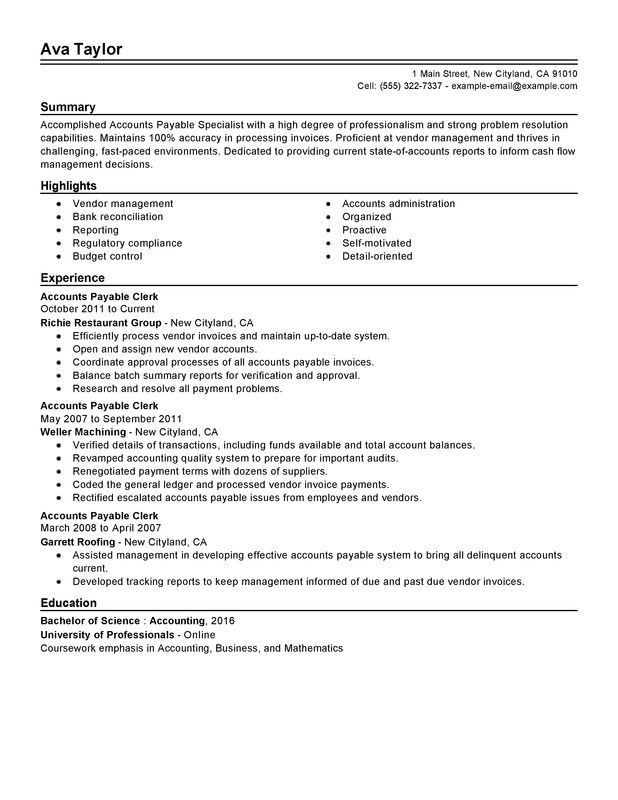

There are plenty of opportunities to land a cash management manager job position but it wont just be handed to you. Cash analyst resume example.

Director Of Finance Resume Samples Qwikresume

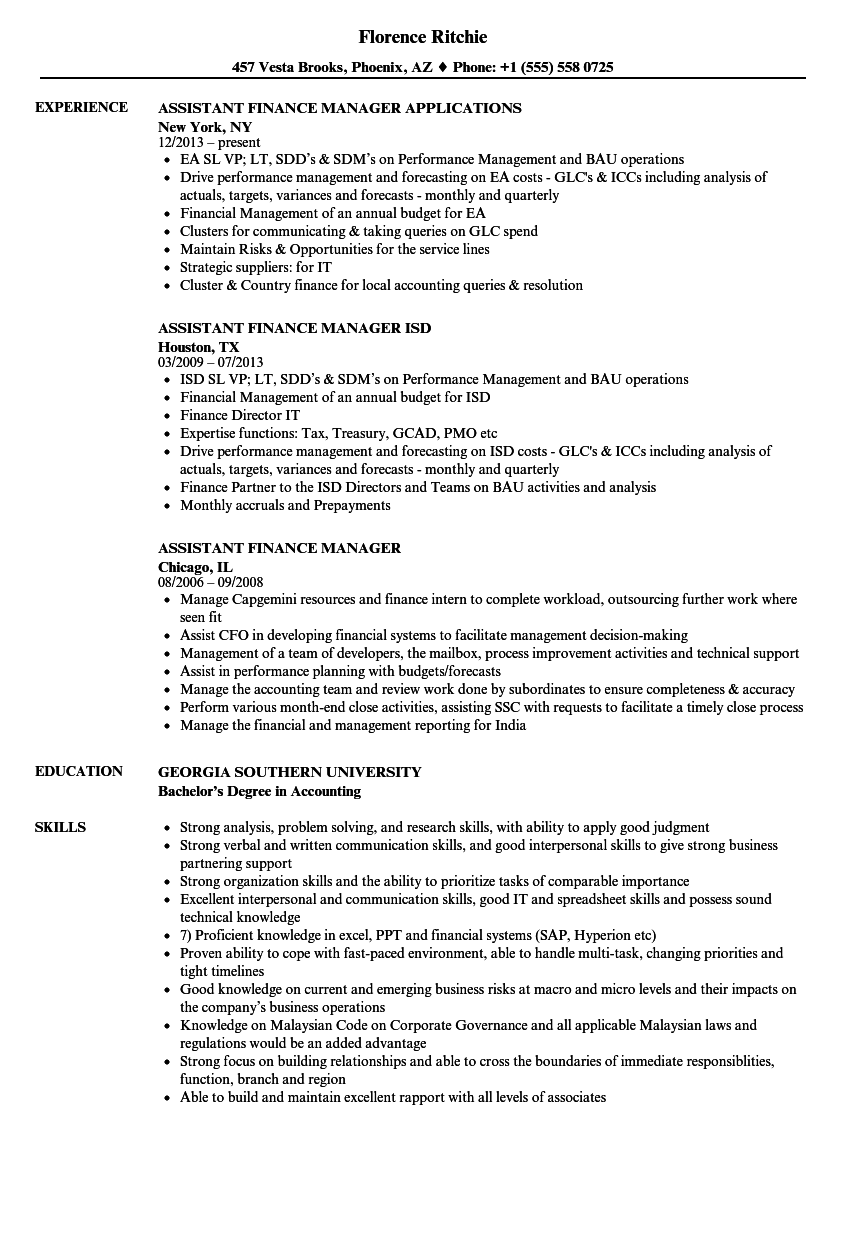

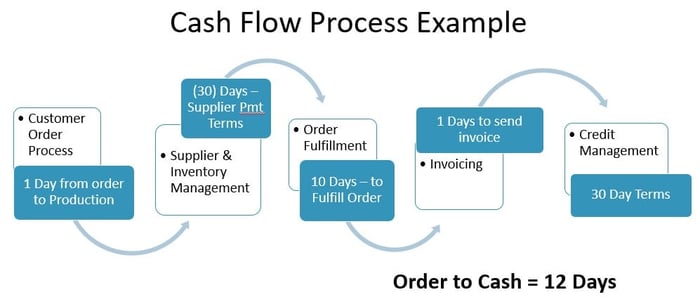

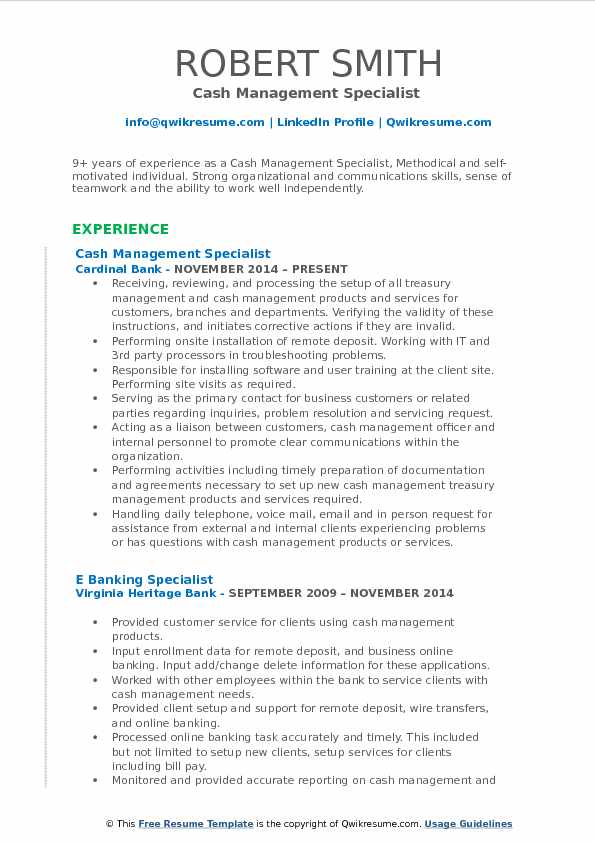

Cash flow management cv. He should have proficiency in posting entries of cash accounts and work with cash flow spreadsheets. Treasurycash management 112007 to current harden healthcare llc austin tx. This could affect how quickly your business can collect money from customers. Cash flow is the money that moves in and out of your business over a defined period of time. Sample resumes of treasury analysts list such skills as maintaining corporate liquidity for entities through the execution of daily cash positioning and preparing monthly treasury journal entries pertaining to intercompany loan interest rent and accrued debt. This helps you spot trends prepare for the future and tackle any problems with your cash flow.

Cash flow analyst monitors the cash flow into and out of the organization. Cash flow management is keeping track of this flow and analyzing any changes to it. Shifts funds as needed in order to maintain liquidity requirements. The job of a cash analyst needs a degree in accounting or business. Managed and reconciled 150mm in debt and 40mm in revolving lines of credit to ensure timely debt reduction and to minimize debt interest charges. Financial plans and cash flow a financial consultant can help you in devising a private business plan for your organizations and the structure of the economic model for your business.

Candidates also have to be experience in accounting and cash reconciliation. View all manager resumes. Cash flows to also aid in routinizing the cash flow process and minimizing the time and involvement of the companys management into routine mundane process. One such role is that of someone who manages cash flow for a financial institution or another office wherein cash transactions are made. In other words its the balance of money your company takes in versus how much it spends. Managed daily cash positioning and cash flow forecasting to minimize borrowing costs.

The definition of cash flow management for business can be summarized as the process of monitoring analyzing and optimizing the net amount of cash receipts minus cash expensesnet cash flow is an important measure of financial health for any business. Their role includes managing bank accounts maintaining financial records performing banking operations providing financial advice to the company and handling the cash management system. Covid 19 border closures and lockdowns are causing supply chain and distribution delays and altering customer purchasing behaviour. Being a cash flow analyst initiates or approves transfers or deposits in response to the funding needs of the organization. Crafting a cash management manager resume that catches the attention of hiring managers is paramount to getting the job and livecareer is here to help you stand out from the competition. It pays to practice cash flow management often to make sure your business has enough money to keep running.

Treasury accountants monitor cash flow in companies and control money transmission tools.